fsa health care limit 2021

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. 10 as the annual contribution limit rises to 2850 up from.

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

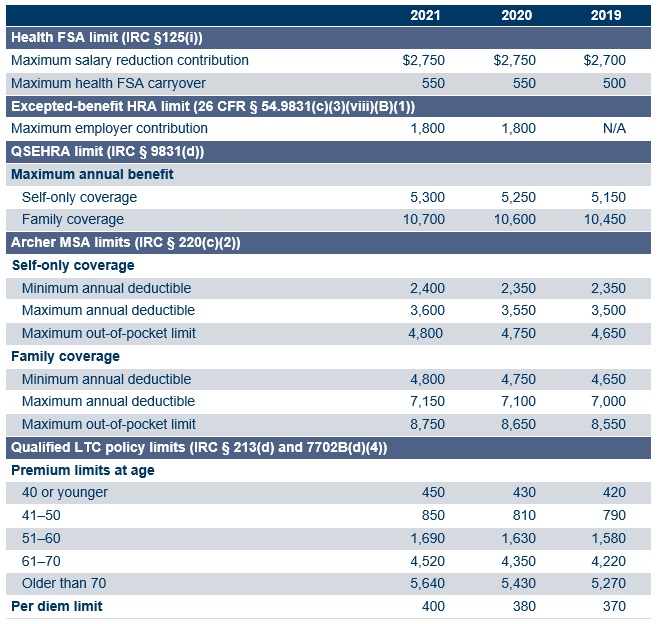

125i IRS Revenue Procedure 2020-45.

. This means youll save an amount equal to the taxes you would have paid on the money you set aside. Plus if you re-enroll in FSAFEDS during Open Season you can. Ad 247 access to mental health support.

Ad Help Your Employees Manage Their Expenses with Fidelitys Reimbursement Accounts Offering. Find official information from Medicare. This dollar limit is indexed for cost-of-living adjustments and may be increased each year.

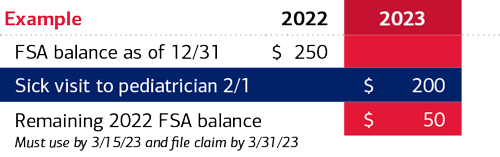

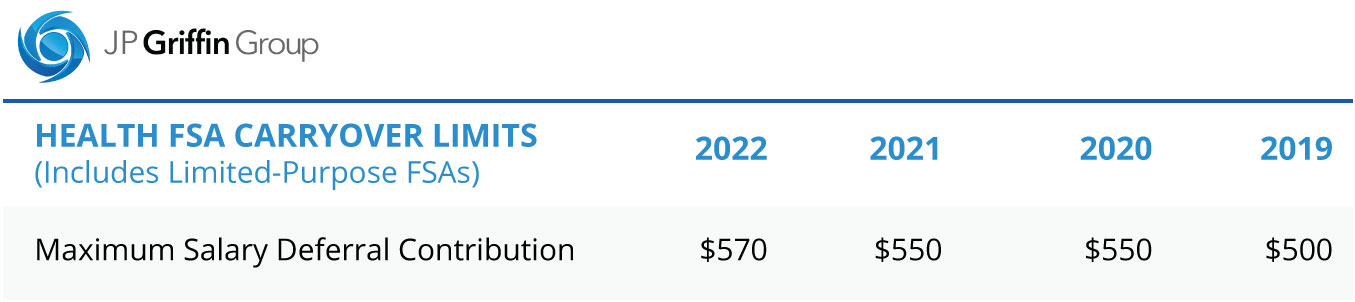

Earlier this year the IRS issued Notice 2020-33 to increase the maximum Health Care FSA carryover amount to 550 or 20 of the Health Care FSA maximum contribution for plan. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Had a Qualifying Event.

NJ Individual Health Coverage Program Carriers for 2021. In 2013 the Affordable Care Act ACA put a cap on Health Care Flexible Spending Account FSA salary reductions subject to Consumer Price Index CPI adjustments in future years. Preventive screenings in every medical plan.

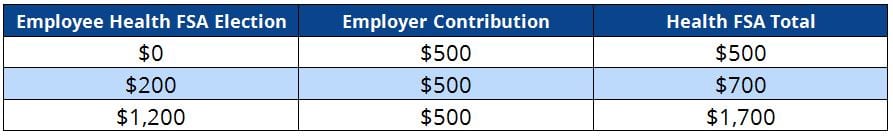

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. 2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health FSA for a plan year. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. Walk-in care options nationwide. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

The health FSA contribution limit will remain at 2750 for 2021. 259 Prospect Plains Road Bldg. Over 1 million doctors pharmacies and clinic locations.

For the 2021 income year it is 2750 26 USC. Employers may continue to impose their own dollar limit on employee salary reduction contributions to Health FSAs. Its a smart simple way to save money while keeping you and your family healthy and protected.

See reviews photos directions phone numbers and more for New Limits Health locations in Piscataway NJ. Ad Save on fsa and hsa approved items. Find Affordable Health Insurance Plans at eHealth Now and Save.

Colgate-Palmolive opened the Volpe Clinical Research Center in Piscataway which it hopes will accelerate development of the companys cutting-edge technology and product formulas. The monthly limit for transportation in a commuter highway vehicle and transit pass provided by an employer to its employees will also remain at 270 per month in 2021. M Cranbury NJ 08512.

Ad Never Go Without Insurance eHealth Makes It Easy Affordable Sign Up Today. Get a free demo. Ad Learn more about the different Medicare parts and get started here.

Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. Learn how to sign up for Medicare. The Tax Cuts and Jobs Act aka Tax Reform enacted December 22 2017 changed the measure of inflation to the average chained CPI-U C-CPI-U for the 12 month period ending August 31.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022.

Easy implementation and comprehensive employee education available 247. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Providing Home Care Services in Clark Westfield Cranford Scotch Plains Rahway Linden Summit Edison Elizabeth Mountainside and all of Northern and Central NJ.

Health-care FSAs can be used for a variety of medical expenses ranging from. In addition as part of COVID-19 relief the. Elevate your health benefits.

The maximum the IRS let workers contributed this year was 2750 but employers may have lower contribution limits. 2020-45 keeps the limit at 550 for 2021. You dont pay taxes on this money.

Call Today 908-418-4299. The health FSA contribution limit is established annually and adjusted for inflation. The Affordable Care Act ACA imposes a dollar limit on employees salary reduction contributions to health flexible spending accounts FSAs offered under cafeteria plans.

Ad Custom benefits solutions for your business needs. 27 2020 the IRS released Revenue Procedure 2020-45 Rev. During the opening ceremony held on June 1 and hosted at Colgates Global Technology Center festivities opened with remarks from Chairman CEO and President Noel.

As a result the IRS has revised contribution limits for 2022. Free 2-Day Shipping with Amazon Prime.

Understanding The Year End Spending Rules For Your Health Account

2021 Year Planner Hra Consulting Photo Calendar Template 2022

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

The 2022 Fsa Contribution Limits Are Here

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Comparing Hsas Hras And Fsas Which Approach Is Best Exude

Irs Announces 2021 Health Fsa Qualified Transportation Limits Lyons Companies

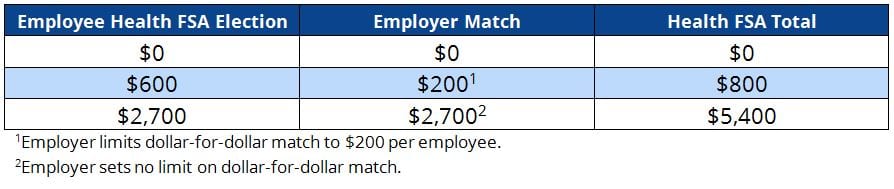

Can Employers Add To Employee Health Fsa Contribution Core Documents

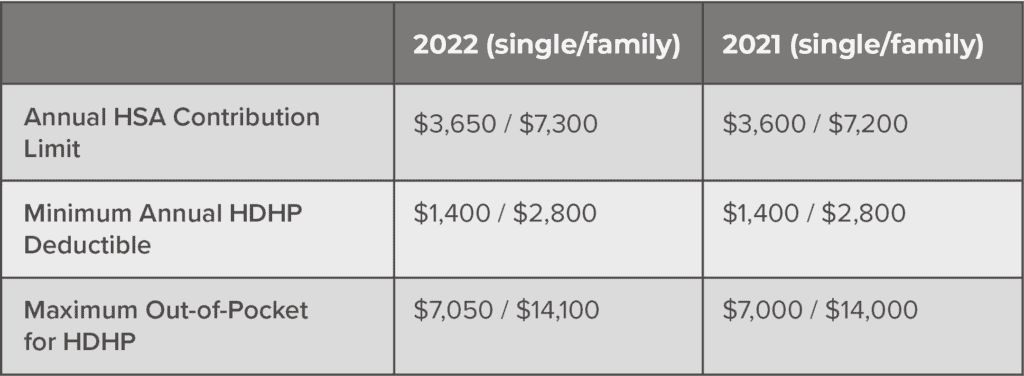

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Contribution Limits 2021 Health Savings Account Personal Budget Personal Finance Advice

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Can Employers Add To Employee Health Fsa Contribution Core Documents

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Irs Adjusts Health Flexible Spending Account Other 2022 Limits