s corp tax calculator nyc

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Complete Edit or Print Tax Forms Instantly.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

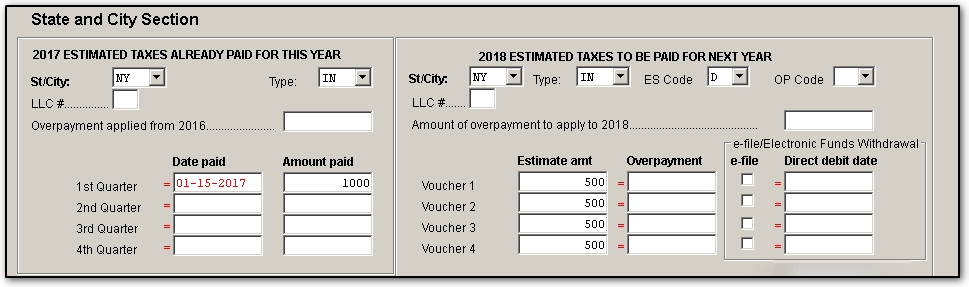

Paying estimated tax If your corporation reasonably expects to owe more than.

. Discussion And Analysis Of Significant Issues Related To Accounting For Expenses. General Corporation Tax GCT Effective for tax years beginning on or after January 1 2015. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Get Started In Your Future. Find A One-Stop Option That Fits Your Investment Strategy. If New York City Receipts are.

Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. Years that may be used in the current tax year for City purposes. All shareholders who earn wages or a salary from a C Corporation.

However one major difference from c corporations is that the new york city s. Not more than 100000. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Taxes Paid Filed - 100 Guarantee. Our small business tax calculator has a separate line item for meals and entertainment. Ad Payroll So Easy You Can Set It Up Run It Yourself.

If you are a qualifying. 10 2022 500 am. Partnership Sole Proprietorship LLC.

The way you compute the tax and the type of return you file will depend on the type of business. Ad Get Started Today and Build Your Future At A Firm With 85 Years Of Investment Experience. If you are a qualifying manufacturer you will have a cap of 350000.

Fixed Dollar Minimum Tax is. Ad Potential Impacts To Income Tax Accounting Including Interim Estimates And Allowances. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address.

The tax-fraud trial of Donald J. This amount may not exceed. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Federal Taxes for C Corps. Check each option youd like to calculate for Option 1. Calculate the proper tax on every transaction.

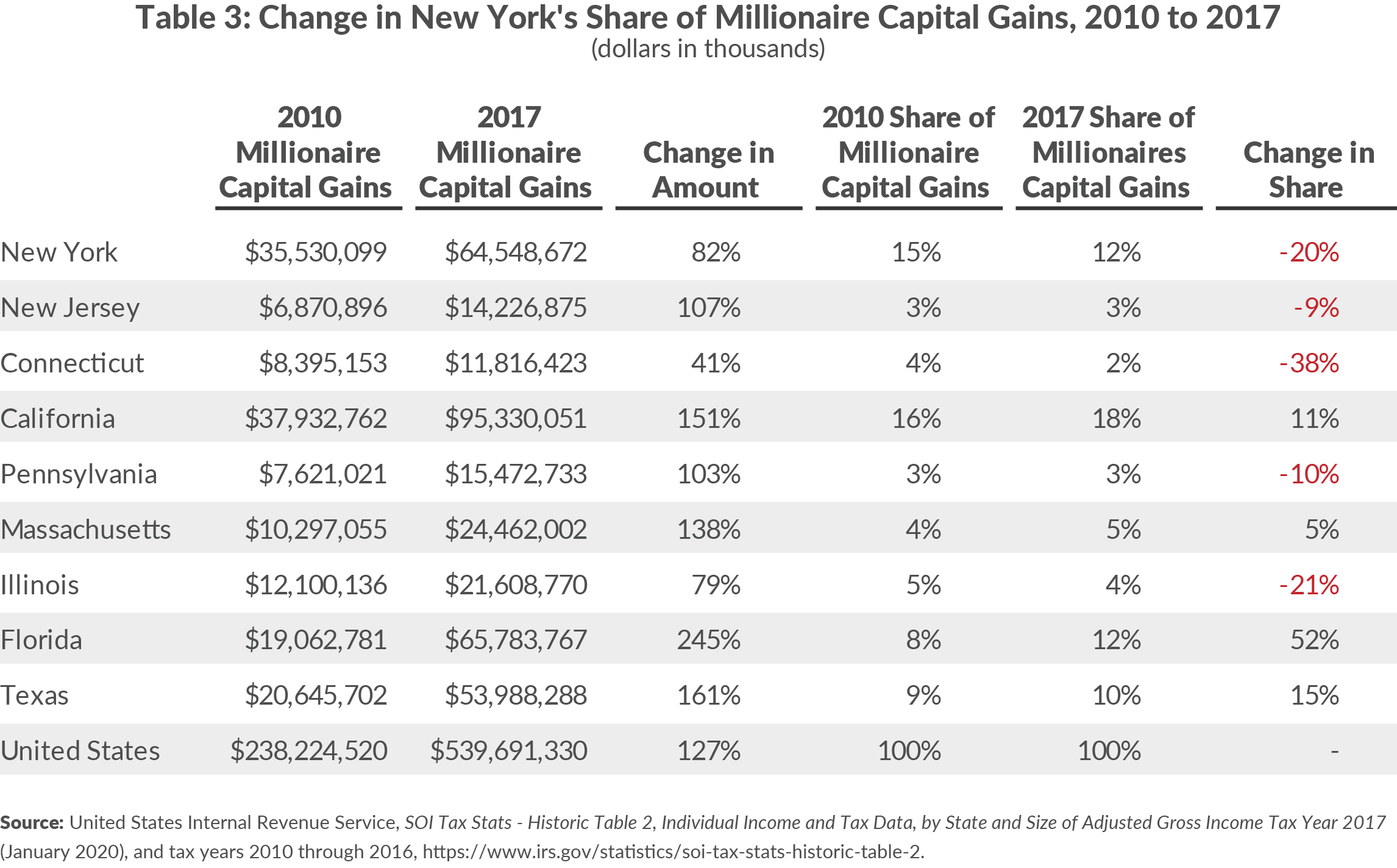

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Download or Email 1120 1120A More Fillable Forms Register and Subscribe Now. When taxing capital the rate is 015 with a cap payment of 1 million.

21020 Annual Self Employment tax as an S-Corp 19125 You Save. Automate your sales tax process. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

For example in New York City an S-corp would be subject to the citys 885 business tax on. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. 1895 Total Savings.

New York Taxes Layers Of Liability Cbcny

Tax Attorneys And Law Firm In New York Capell Barnett Matalon Schoenfeld

Tax Savings Calculator For Llc Vs S Corp Gusto

S Corp Vs Llc Which Is Best For Your Business Smartasset

New York State Taxes For Small Businesses An Overview Bench Accounting

S Corp Election Self Employment S Corporation Taxes Wcg Cpas

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Sales Taxes In The United States Wikipedia

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How To Convert To An S Corp 4 Easy Steps Taxhub

Los Angeles Sales Tax Rate And Calculator 2021 Wise

S Corp Federal Tax Filing Dates Turbotax Tax Tips Videos

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Ny State And City Payment Frequently Asked Questions

Filing Taxes As An S Corp The Diy Guide

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official